How to Pass Bookmakers KYC & Source of Wealth Requests

Dealing with Know Your Customer (KYC) checks quickly is an essential part of matched betting.

Signing up with many different bookmakers means you have to meet all of their requirements, which are in place to prevent underage gambling.

What Is A KYC Check?

KYC stands for Know Your Customer.

It is a way for the UK Gambling Commission to make sure that only those people who are over the age of 18 can gamble online.

To be clear, these checks are not up to the bookmaker. If they want to legally comply with regulations, they must be able to positively confirm that every single one of their customers is legally allowed to be using their service.

If bookmakers fail to meet these regulations, they can be heavily fined by the UK Gambling Commission, or even shut down.

Why Have I Been Asked?

Nobody is exempt from ID requirements.

Even if you have been allowed to sign up for a bookmaker and deposit funds, before you are allowed to withdraw them you must provide some form of identification to the bookmaker.

Prior to 2019, it was the case that you were allowed to sign up, deposit funds, and place bets for 72 hours after creating your account. To withdraw, you still had to provide ID.

However, new regulations put in place by the government have prevented this, as it technically allowed anyone (including those under the age of 18) to make bets, even though they couldn’t withdraw their winnings.

You must now provide ID and get verified before you can place any bets. This new regulation is more effective at preventing underage gambling, but it makes life more difficult for matched betting

You need to be able to sign up for a new bookmaker quickly so you can take advantage of certain offers.

The best way to do this now is to make sure you have all of your documents ready to go, so you can sign up and get verified as quickly as possible.

KYC And Source Of Wealth Documents

There are a number of different documents you are able to provide to bookmakers to confirm your ID. Essentially, they need to be able to confirm your name, date of birth, and address.

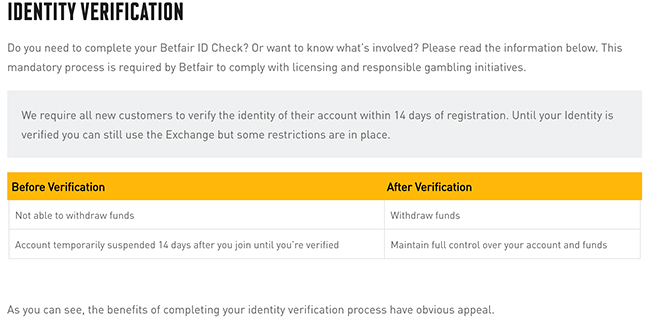

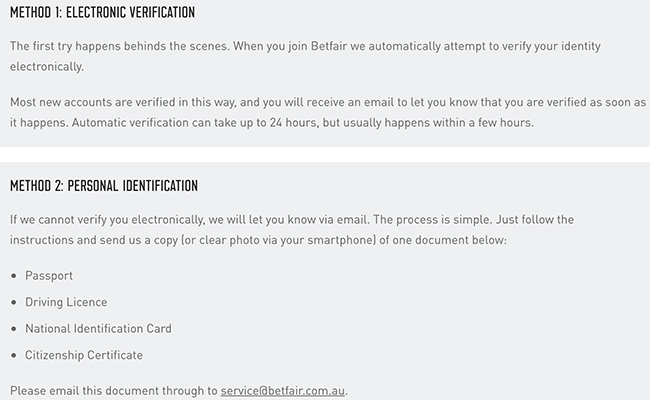

Some sites, such as Betfair, attempt to complete your identity verification electronically, without the need for you to provide documentation as proof. They can check the electoral register, for example.

The most common form of ID that people use is a passport, but some prefer to use a driving license. Both of these documents can confirm your name and date of birth.

Occasionally, for those people without a passport or driving license, you can use a birth certificate, but this has been known to take longer to verify.

You will always need these documents, so it is worth getting a copy scanned properly, to make sure it is clear and ready to go whenever you need it.

As previously mentioned, you will also need to prove your address. You can do this with either a bank statement or utility bill from the last 3 months.

This is a bit more tricky, as you will need to keep updating these documents as time goes on. You can go into your local bank branch and ask them to print off a statement for you. Doing this once every 3 months is a bit of a hassle, but it can be necessary.

You may also have been asked for source of wealth documents. This is usually if you have been betting large sums of money with a betting exchange.

A source of wealth check is a request for specific information about your source of income, so maybe a salary or investment returns, or payslips from your job.

The reasons for asking for a source of wealth check are different from a regular KYC check. While KYC is mainly regarding customer identification, source of wealth checks are all about combating money laundering.

Again, these checks are in place as a result of regulations enforced by the UK Gambling Commission.

The legislation is in place to prevent criminals using money gained through illicit means as gambling funds, and then using those gambling profits as their own ‘legal’ source of wealth.

If you are asked for a source of wealth check, there are a few different documents you can use. Smarkets, for example, will accept the following:

- Proof of earnings: Payslip/Director remuneration/Dividends/Pension.

- A bank statement that clearly shows consistent incoming values from an identifiable source.

- Other clear evidence that would support “affordability” in relation to your trading with us.

You must also show that the accounts which these earnings are paid into are directly linked to your deposits into the exchange.

You usually shouldn’t have to worry about a source of wealth check unless you are staking substantial amounts of money.

There are no fixed amounts quoted on Smarkets for the minimum threshold required for these checks to be triggered, but users have reported it to be for deposits around £50,000.

How Will This Information Be Used?

Once the bookmaker has your information, they will process it and verify it against official records to make sure your identification isn’t forged or fake.

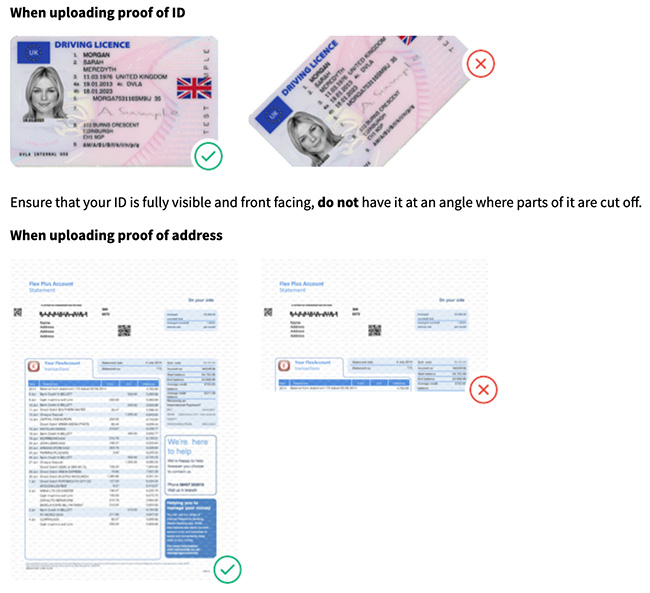

They will be checking your ID visually, so you need to make sure it is completely legible.

This means you need a high-quality scan, with the entire document visible, and no corners cut off. If the original document is in colour, make sure you provide a full-colour scan.

Your information is stored securely and only shared with government regulatory bodies.

You shouldn’t worry about your documents being stolen and used for fraud purposes. Generally, the bigger the bookmaker, the more secure their servers are, as they can afford more intensive security.

If you are leaving a bookmaker, you can ask them to remove any information they have stored about you from their servers. Just send an email to their helpline, or use the live chat feature on sites such as Betfair.

How Long Will It Take?

It is usually in the best interests of the bookmaker to make sure the checks are verified in a timely manner. This means the customer can start gambling as quick as possible!

Prior to 2019, it was the case that a bookmaker or online casino had 72 hours to perform age and identity verification.

This became a problem, however, as punters were depositing funds, gambling, and having big wins, but then couldn’t withdraw their winnings before getting their identity verified.

Many bookmakers were accused of ‘delaying tactics’ or making it more difficult than usual to provide identity verification for customers who had big wins and were waiting to withdraw large sums of money.

Some bookmakers would even ask for what is known as a ‘notarised ID’. It is a way of certifying that a photocopy of a document is a true likeness of the original. It can be done at a Post Office but costs £12.75 to do.

Usually, this kind of check is fairly unnecessary and was likely a tactic from bookmakers to make customers waiting on big payouts less likely to collect, or at least delay the withdrawal as long as possible.

This kind of check is not required by the UK Gambling Commission and is enforced only by the bookmaker themselves.

Generally, it is good practice to stay away from bookmakers who ask for these kind of overly extensive checks, as it shows bad practice.

As of May 2019, all bookmakers based in the UK must verify the age and identity of every one of their customers immediately after account creation, and before they can access any of the services provided by the bookmaker.

This is a good way of combating underage gambling, but will it increase the amount of time you spend waiting to hear back from your KYC check?

Hopefully not. As a rough guide, and depending on the bookmaker and the kind of documents you provide, you should expect to receive the results of your checks back within 48 hours.

Bet365 state that although most checks should be completed within 48 hours, it may take up to 7 days to verify your ID when ‘volumes are high’.

Smarkets state that if they have not been able to verify your account within 72 hours, your account will be suspended until they receive proper verification.

If you find that it is taking the bookmaker an unnecessarily long amount of time to complete your KYC checks, the best thing to do is to speak to the UK Gambling Commission.

You should forward any email correspondence you have had with the bookmaker to the Commission at info@gamblingcommission.gov.uk, and hopefully, they can deal with the bookmaker, or at least give you advice as to how to proceed.

Since the new regulations have come into place, things have been running fairly smoothly. Time will tell if the new changes are effective.

About the Author

This post was written by Andy Beggs. Andy is a keen sports fan and has been writing for Beating Betting from his home in Australia since August 2019.

There’s been reports of some bookies not playing ball with KYC checks. Let’s hope that the UKGC enforce the rules properly.