Hedge Betting Strategy: How To Hedge Your Bets

You may have heard the phrase ‘hedge your bets’ being thrown around before.

If you don’t know the real meaning then you are missing out on a great betting strategy to lock in profit whatever the outcome of an event.

Fortunately for you, this guide will teach you how to hedge your bets and the hedging strategies to get you earning some extra money.

What is Hedge Betting?

Hedge betting comes from the financial world as does many profitable strategies.

It is the technique of placing two bets on the same betting market to take advantage in the movement of odds.

The best way to do this is by using a betting exchange like Betfair Exchange or Smarkets. These allow us to place lay bets – meaning we are betting on something not to happen.

If you can back for higher odds and lay for lower odds this is where the profit lies.

Hedging acts almost as an insurance mechanism. There is no need to gamble and worry about whether your bet is coming in. If you’re happy to take less of a payout, when done correctly, it can take away the chance of you losing.

It also acts as a way to cut your losses. Sometimes you place a bad bet or the odds don’t move in your favour. If we’re serious about making money from betting then we have to accept occasional losses are part of the process.

However, losing our whole stake is something that we can avoid. By placing a lay bet as close to the original odds a possible it will minimise the loss greatly.

Remember – if we have to lose, taking small losses is what keeps the profit high.

Hedging your bets is an incredibly important system to learn.

It is used in matched betting as well as Betfair trading. Getting a good grasp of hedging strategies will stand you in good stead should you ever get into either.

How to Hedge Your Bets

Hedging is a very versatile strategy.

Sometimes you need to hedge your bets very quickly and sometimes it might be weeks or months before you need to consider hedging.

This is based on whether you’re hedging in-play or on a long-term market, like a competition outcome.

We are going to explain how best to use both hedging strategies below.

Outright Market Hedging

An outright market is when a bookmaker takes bets on tournament and competition outcomes rather than individual matches. The most common thing to bet on is to bet on the outright winner but there are many markets within this – highest points/goal scorer is an example.

This market will normally be the first bets that are offered and will run throughout the event.

Let’s take a look at an example.

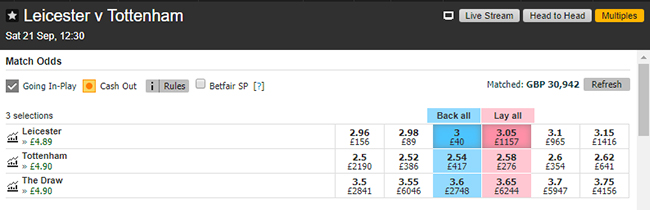

Paddy Power are offering odds of 2.4 for Liverpool to be the winners of the Premier League.

We see this as good value. Manchester City are the favourites but we expect Liverpool, at the very least, to run them close.

If Liverpool were to go on and win the title we would be taking home £1,200. That’s £700 in pure profit.

That’s a pretty good return.

However, the Premier League is a long, hard competition run over ten months.

As expected both Liverpool and Man City have started well. They are first and second respectively coming into the final few months of the season. Liverpool have built up a lead of six points over Man City.

This is always the crunch point in a season. The games come thick and fast, with teams having to play in multiple competitions.

Man City have a much better squad to deal with this amount of games and any injuries that may affect key players.

Although we are still in with a good chance of the bet winning we’re not as confident as we once were.

Most people would sit on it and watch the games nervously.

Fortunately, we’re not most people. Being familiar with hedging bets we decide to take another look at the odds.

Liverpool are now as low as 1.25 to lay at Betfair Exchange.

Laying simply means to bet against something.

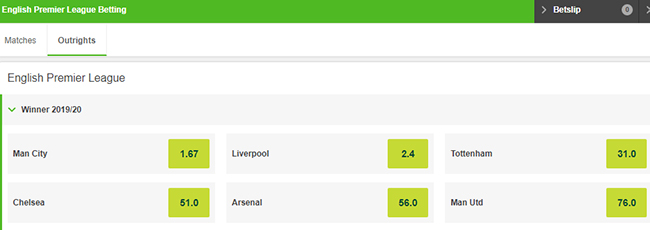

If we go to a hedging calculator and enter all the information it will present us with this…

If we place a £1000 lay bet on Liverpool we stand to win £450 whether Liverpool win or not!

This is possible because we have bet on Liverpool to win and not to win. By using the movement in the odds and an altered lay stake it leaves us with a win whatever the outcome of the Premier League.

It may sound a bit complex to get your head around at first but it’s really simple.

Just remember – to hedge your bet profitably we need the back odds to be high and the lay odds to be lower.

By doing this it does mean we have to take less profit than the original bet promised us. Liverpool to win would have won £700, that’s £250 more than what we would have won by hedging.

It’s important to remember risk versus reward.

Is it better to let the bet run and potentially lose £500? Assessing all the information we think not.

This is the advantage of hedge betting. It becomes a valuable strategy to make consistent profits. By hedging your bets you can look to minimise risk and build your bankroll steadily.

Hedging In-play

Stepping into the in-play market is always fun. Fast-paced and plenty of markets there’s potential for quick profit.

Remember, if you’re gambling regularly more often than not the bookies will beat you!

Using a similar hedging strategy we can look to improve our chances.

Because we have to move quickly when betting in-play all of the bets we are going to place will be on an exchange like Smarkets or Betfair Exchange. Here we can back and lay one after another.

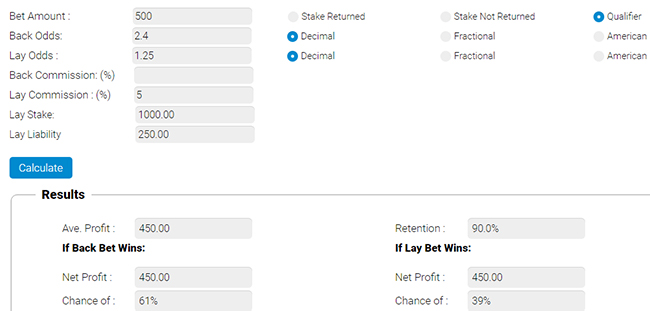

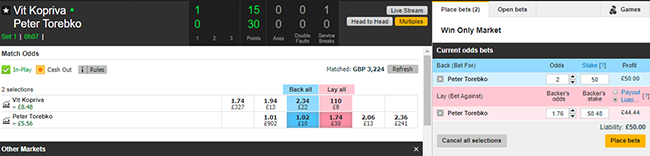

Take a look at this tennis market…

We’re in the match winner market and think there’s money to be made in this match. We place a back bet on Torebko to win.

As the game progresses we notice that the odds of Torebko have started to fall.

Knowing about hedging this represents a point we can make some money. Rather than stay in the market and risk losing the stake we decide to hedge.

We can lay for 1.76.

Using a calculator, as before, it will show the lay stake we need to enter.

By laying £58.48 we have found a price point where the lay odds are lower than the original back odds.

This means we can profit £5.56 whatever the outcome.

You can see how important hedging bets can be to bettors. It’s an invaluable tip to not only get you out of trouble but also look to create profit.

As you may have noticed by targeting movement of odds you can look to create a profitable hedging strategy. More on this to come.

Hedging Your Losses

If we’re in the market and it starts to move against us knowing how to hedge your bet will always be valuable.

You may not be able to avoid making a loss but it will minimise it.

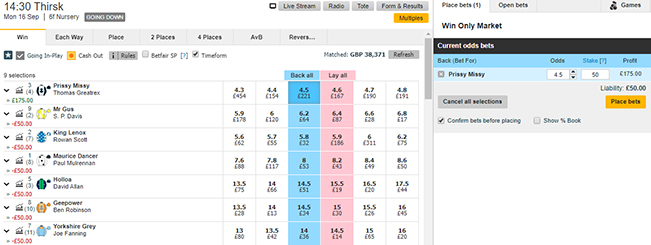

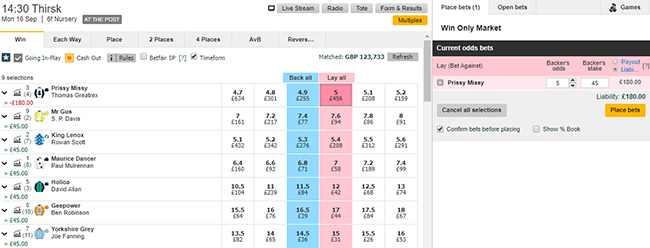

After placing a £50 back bet on Prissy Missy the odds start to move against us and the horse isn’t looking good as they line up.

The market has noticed this and is starting to drift further and further from the back price we managed to get.

Knowing it’s likely we are onto a loss we get back into the market quickly.

With the shift in odds for Prissy Missy up to 5, we place a £45 lay bet.

This leaves a loss of £5 whatever the outcome.

As you can see, our thoughts about how the horse was looking were correct. It ended up coming third by a fair amount.

Because we hedged our bets it means we only lost £5 instead of £50. That’s a tenth of the original loss.

Hedging bets is important when it comes to cutting your losses but also when guaranteeing your winnings.

Remember we compared hedge betting to an insurance mechanism at the start of the guide?

Well, this is why.

It can get you out of trouble as much as it can help you profit.

Tips and Tricks

Always weigh up risk and reward. You don’t want to be overly cautious and implement a hedging strategy that takes away from your profit.

Instead, it can be used as a plan B when things might not be heading the way you want. As you get more experienced you will be able to start reading the way odds are moving a bit more.

You might have also spotted how hedging your bets means you can take advantage of movement of odds?

It’s not necessary to need to know the winner of an event with hedging. As long as you can get a feel for which way the odds are going to move you can hedge for profit.

This is what sports traders having been doing on Betfair Exchange very profitably since its release.

About the Author

This post was written by Max. Max has been writing and editing for Beating Betting since August 2019. He's a massive sports fan and got into matched betting a few years ago.